Asset allocation refers to diversification of your investments in more than one asset class. Asset allocation for most investors means diversifying into equity and fixed income or debt. In our blog post, How can multi asset allocation work for you?, we had discussed the benefits of diversification across 3 or more asset classes. We had seen how you can achieve better risk diversification with asset allocation in equity, debt and gold. Multi Asset Allocation Funds invests across 3 or more asset classes with minimum 10% minimum 10% each in at least 3 asset classes (as per SEBI’s mandate). In this post, we will discuss how a fourth asset class, international equity can help you balance risk and return better.

EDGE asset allocation framework

EDGE is an asset allocation framework, where you diversify your portfolio across four asset classes:-

- Domestic Equity

- Domestic Debt

- Gold

- International Equity

We will discuss the characteristics of each asset class in brief:-

- Domestic equity: Shares of Indian companies listed on stock exchanges constitute the domestic equity asset class. Though domestic equity as an asset class can be volatile in the short term, historical data shows that it can outperform other asset classes like fixed income and gold over long investment horizon. In the last 10 years Nifty 50 TRI, the leading market benchmark index for Indian equities gave 13.2% CAGR returns (source: Advisorkhoj Research, as on 31st December 2022. CAGR is compounded annual growth rate, which means the investment’s annualized growth rate assuming profits are reinvested every year).

You need to have high risk appetite for equity as an asset class. The main investment objective for investing in domestic equity is capital appreciation or wealth creation. You can get exposure to domestic equity either by directly investing in stocks or through equity mutual funds. Equity mutual funds are managed by professional fund managers and offer the benefits of risk diversification. - Domestic debt: Debt and money market instruments constitute domestic fixed income or debt asset class. Government bonds (G-Secs), State Development Loans (SDLs), Non Convertible Debentures (NCDs), Commercial Papers (CPs), Certificates of Deposits (CDs), Treasury Bills (T-Bills), Tri Party Repos (TREPs) etc are examples of debt and money market instruments. Debt as an asset class is relatively less volatile compared to equities or gold.

Asset allocation to debt reduces downside risks, brings stability to your investment portfolio and generates income for investors. They are suitable for investors with conservative to moderate risk appetites or for investors who need regular income from their investments. Debt mutual funds are suitable and tax efficient investment options for investors who want exposure to debt as an asset class. - Gold: Gold is an important asset class in India since time immemorial. Gold is considered to be an auspicious commodity in Indian culture. India is one of the largest markets of gold in the world. Indian families buy gold on auspicious occasions like Akshay Tritiya, Dhanteras, Deepawali, weddings etc. Its cultural significance aside, gold as an asset class also has a huge economic importance since gold is seen as a store of economic value over the long term. Over a long period of time gold is supposed to retain its purchasing power and is therefore seen as a hedge against inflation. Over the last 20 years, gold has given 11.6% CAGR return which is higher than inflation rate (source: Advisorkhoj Research, as on 31st December 2022).

Gold is also an important asset class for asset allocation purpose, since it is usually counter-cyclical to equities i.e. gold outperforms when equity underperforms and vice versa. Gold is suitable for investors with long investment horizons and conservative to moderate risk appetites. Adding gold to your investment portfolio will bring more stability to your portfolio. Gold Exchange Traded Funds (ETFs) or gold Fund of Funds (FOFs) are highly convenient, safe and cost efficient investment options if you want to take exposure in gold for investment purposes. - International Equity: International equity refers to international stocks or shares of overseas companies, listed on international stock exchanges. Investors in developed markets allocate a portion of their assets to international equities, but investing in international equities has traditionally been not very popular in India. However, this trend is changing and interest in international equities has been increasing in the India over the past few years. Investing in international equities has several advantages. When you are investing only in domestic equities, you are exposed to single country risk. Most investors tend to ignore this risk but the risk is real and can be diversified by investing in international equities.

Secondly, there is low or even negative correlation between returns of the different countries (we will discuss this in more details in the next section). Investing in international equities will provide stability to your equity portfolio during periods when domestic equity underperforms. Thirdly, investing in international equities can provide you exposure to global themes and megatrends, which are not yet fully developed in India e.g. Artificial Intelligence, Cyber security, Fintech, E-Commerce, Cloud Computing, Social Media, Gaming, Electric Vehicles, Semiconductors etc. Finally, you can benefit from currency depreciation by investing in international equities, especially in counties e.g. United States, where the foreign currency (e.g. USD) is appreciating against the Indian Rupee (INR). You can get exposure to international equities by investing international Fund of Funds.

How investing in EDGE asset allocation diversifies risk?

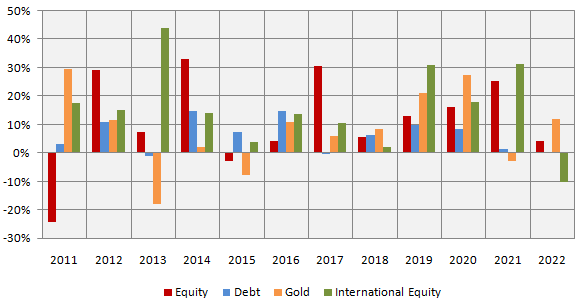

The chart below shows the annual returns of different asset classes over the last 10 years or so. You can see that different asset classes have outperformed / underperformed each other in different periods. In the chart below, domestic equity is represented by Nifty 50 TRI, debt by Nifty 10 year Benchmark G-Sec Index, gold by gold prices in INR and international equity by S&P 500 in INR. Please note that we are using S&P 500 in INR as a proxy for international equity purely for illustrative purposes. S&P 500 is the benchmark index of 500 large cap companies in the US and is one of the most globally recognized market benchmark indices of equities.

Source: National Stock Exchange, Advisorkhoj Research, Yahoo Finance, as on 31st December 2022. Equity: Nifty 50 TRI, Debt: Nifty 10 year Benchmark G-Sec Index, Gold: Domestic price (INR) of gold, International Equity: S&P 500 in INR. Disclaimer: Past performance may or may not be sustained in the future. The above illustration is purely for investor education purposes and should not be construed as investment recommendations. You should invest according to your risk appetite and investment needs; consult with your financial advisor before investing.

How multi asset allocation may have performed?

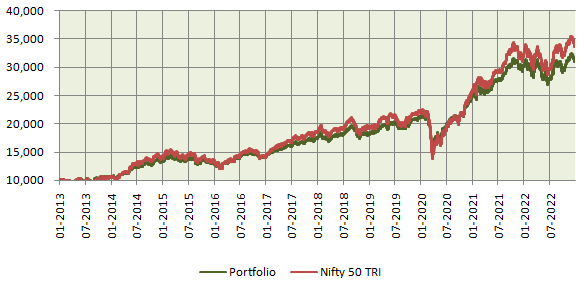

We are using a hypothetical multi asset portfolio comprising of the EDGE asset classes to see how they may have performed over the last 10 years versus the Nifty 50 TRI. The hypothetical portfolio comprises of 70% domestic equity (Nifty 50 TRI), 10% debt (Nifty 10 year Benchmark G-Sec), 10% gold and 10% international equities (S&P 500 in INR). The chart below shows the growth of Rs 10,000 investment in this hypothetical portfolio versus the Nifty 50 TRI. The 10 year CAGR returnof the portfolio was 12%, while the 10 year CAGR return of Nifty 50 TRI was 13% (source: Advisorkhoj Research, as on 31st December 2022).

Source: National Stock Exchange, Advisorkhoj Research, Yahoo Finance, as on 31st December 2022. Portfolio comprises of 70% Nifty 50 TRI, 10% Nifty 10 year Benchmark G-Sec Index, 10% gold (in INR) and 10% S&P 500 (in INR). Disclaimer: Past performance may or may not be sustained in the future. The above illustration is purely for investor education purposes and should not be construed as investment recommendations. You should invest according to your risk appetite and investment needs; consult with your financial advisor before investing.

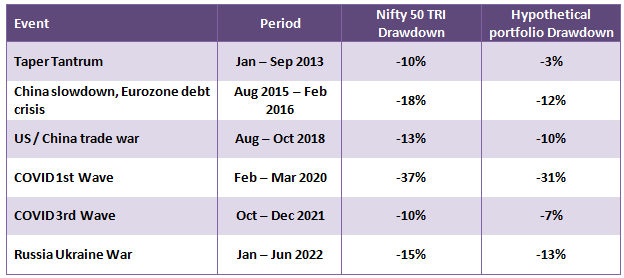

You can see that the returns of the hypothetical multi asset portfolio comprising of domestic equity, debt, gold and international equity was similar to Nifty. Let us now see how the portfolio performed in market corrections. You can see that the hypothetical portfolio comprising of the EDGE asset classes was able to limit downside risks compared to Nifty. This is because some of the asset classes in the hypothetical portfolio e.g. gold, international equities outperformed when domestic equities underperformed. You can see that multi asset allocation has the potential of generating risk adjusted returns.

Source: National Stock Exchange, Advisorkhoj Research, Yahoo Finance, as on 31st December 2022. Portfolio comprises of 70% Nifty 50 TRI, 10% Nifty 10 year Benchmark G-Sec Index, 10% gold (in INR) and 10% S&P 500 (in INR). Disclaimer: Past performance may or may not be sustained in the future. The above illustration is purely for investor education purposes and should not be construed as investment recommendations. You should invest according to your risk appetite and investment needs; consult with your financial advisor before investing.

Who should invest in multi asset allocation funds?

- Investors seeking exposure to multiple asset classes in a single scheme

- Investors looking for capital appreciation and income over long investment horizon

- You should have moderately high to high risk appetites for multi asset allocation funds

- You should have minimum 3 year investment tenures for these funds

- You should read the scheme information document carefully to understand the asset allocation strategy and risk profile of the fund before investing. You should always invest according to your risk appetite.

Investors should consult with their financial advisors, if multi asset allocation funds are suitable for their investment needs.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.