Nippon-India-Multi-Cap-Fund-Growth-Plan-Growth-Option

Fund Manager : Sailesh Raj Bhan, Ashutosh Bhargava | Benchmark : Nifty 500 Multicap 50:25:25 TRI | Category : Equity: Multi Cap

NAV as on 14-05-2024

AUM as on 30-04-2024

Rtn ( Since Inception )

18.55%

Inception Date

Mar 25, 2005

Expense Ratio

1.61%

Fund Status

Open Ended Scheme

Min. Investment (Rs)

100

Min. Topup (Rs)

100

Min. SIP Amount (Rs)

100

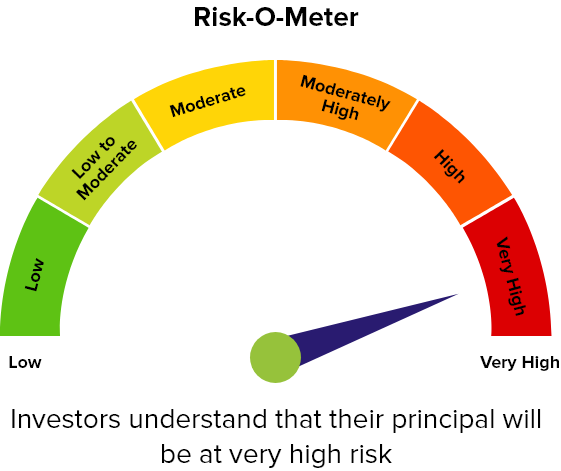

Risk Status

very high

Investment Objective : The scheme aims to invest in stocks across those sectors and industries where Indias strong inherent potential is increasingly becoming visible to the world, which are driving our economy and whose fundamental future growth is influenced by ongoing economic reforms, FDI inflows and infrastructural changes.

Returns (%)

| 1 Mon (%) | 3 Mon (%) | 6 Mon (%) | 1 Yr (%) | 3 Yrs (%) | 5 Yrs (%) | 10 Yrs (%) | |

|---|---|---|---|---|---|---|---|

| Fund | 2.57 | 9.02 | 23.76 | 48.92 | 31.65 | 22.37 | 17.48 |

| Benchmark - NIFTY500 MULTICAP 50:25:25 TRI | -0.02 | 4.08 | 20.31 | 42.62 | 22.52 | 21.6 | 17.16 |

| Category - Equity: Multi Cap | 0.7 | 4.97 | 20.24 | 42.92 | 22.93 | 22.45 | 17.57 |

| Rank within Category | 3 | 1 | 5 | 5 | 1 | 3 | 2 |

| Number of Funds within Category | 24 | 24 | 23 | 19 | 9 | 7 | 6 |

Returns less than 1 year are in absolute and Returns greater than 1 year period are compounded annualised (CAGR)

Equity Holdings (Top 10)

| Sector | Allocation (%) |

|---|

Sector Allocation (%)

Asset Allocation

| Asset Class | Allocation (%) |

|---|---|

| Equity | 98.98 |

| Cash & Cash Equivalent | 1.01 |

| Debt | 0.01 |

Portfolio Behavior

| Mean | 26.95 |

| Sharpe Ratio | 1.67 |

| Alpha | 9.68 |

| Beta | 0.9 |

| Standard Deviation | 13.08 |

| Sortino | 2.77 |

| Portfolio Turnover | 29 |

Market Cap Distribution

Yearly Performance (%)

Standard Performance

Riskometer

SIP Returns (Monthly SIP of Rs. 10,000)

| 3 Year | 5 Year | 10 Year | 15 Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scheme Name | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) |

| Nippon India Multi Cap Gr Gr | 360,000 | 555,676 | 32.07 | 600,000 | 1,256,208 | 31.02 | 1,200,000 | 3,248,476 | 19.18 | 1,800,000 | 7,730,089 | 17.73 |

| NIFTY500 MULTICAP 50:25:25 TRI | 360,000 | 501,116 | 24.01 | 600,000 | 1,109,730 | 25.65 | 1,200,000 | 3,035,648 | 17.91 | 1,800,000 | 6,948,557 | 16.5 |

| Equity: Multi Cap | 360,000 | 507,376 | 24.9 | 600,000 | 1,123,162 | 26.02 | 1,200,000 | 3,125,669 | 18.26 | 1,800,000 | 7,639,452 | 17.43 |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Past performance may or may not be sustained in the future. Investors should always invest according to their risk appetite and consult with their mutual fund distributors or financial advisor before investing.