SBI-Magnum-Income-Fund-Regular-Plan-Growth

Fund Manager : Lokesh Mallya, Pradeep Kesavan, Adesh Sharma | Benchmark : CRISIL Medium to Long Duration Fund BIII Index | Category : Debt: Medium to Long Duration

NAV as on 14-05-2024

AUM as on 30-04-2024

Rtn ( Since Inception )

7.56%

Inception Date

Nov 25, 1998

Expense Ratio

1.46%

Fund Status

Open Ended Scheme

Min. Investment (Rs)

5,000

Min. Topup (Rs)

1,000

Min. SIP Amount (Rs)

500

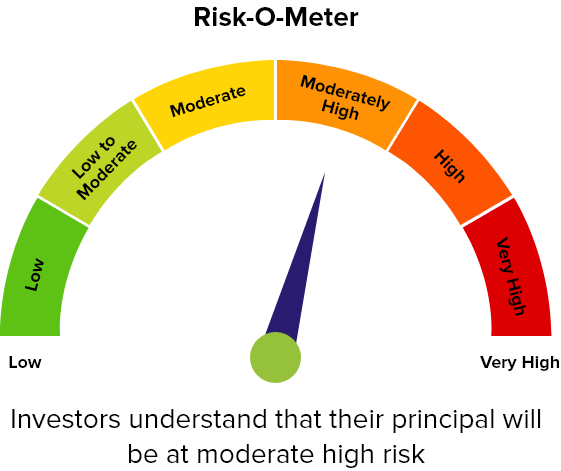

Risk Status

moderately high

Investment Objective : The scheme aims at generating returns through investments primarily in debt and money market instruments.

Returns (%)

| 1 Mon (%) | 3 Mon (%) | 6 Mon (%) | 1 Yr (%) | 3 Yrs (%) | 5 Yrs (%) | 10 Yrs (%) | |

|---|---|---|---|---|---|---|---|

| Fund | 0.85 | 1.58 | 3.88 | 6.17 | 5.24 | 7.45 | 7.87 |

| Benchmark - S&P BSE India Bond Index | 0.79 | 1.87 | 4.98 | 7.36 | 5.85 | 7.62 | 8.51 |

| Category - Debt: Medium to Long Duration | 0.89 | 1.53 | 4.21 | 5.76 | 4.98 | 5.94 | 6.79 |

| Rank within Category | 9 | 4 | 11 | 3 | 3 | 1 | 1 |

| Number of Funds within Category | 11 | 11 | 11 | 11 | 11 | 11 | 11 |

Returns less than 1 year are in absolute and Returns greater than 1 year period are compounded annualised (CAGR)

Debt Holdings (Top 10)

| Sector | Allocation (%) |

|---|

Credit Quality Break Down

| Credit Quality | Portfolio (%) |

|---|---|

| SOV | 41.08 |

| AAA | 11.94 |

| AA | 11.91 |

| A | - |

| BBB | - |

| Below BBB | - |

| D | - |

| AA+ | 11.49 |

| AA- | 10.77 |

Asset Type (Top 5)

| Debenture | 38.91 |

| GOI Securities | 36.79 |

| Repo | 10.21 |

| Non Convertible Debenture | 7.2 |

| State Development Loan | 4.29 |

Portfolio Behavior

| Mean | 5.3 |

| Sharpe Ratio | 0.11 |

| Alpha | 0.13 |

| Beta | 0.92 |

| Standard Deviation | 1.7 |

| Sortino | 0.15 |

Debt Profile

| Scheme | Category | % of Change | |

|---|---|---|---|

| Modified Duration | 0 | ||

| Average Maturity | 0 | ||

| Yield To Maturity | 0 | ||

Yearly Performance (%)

Standard Performance

Riskometer

SIP Returns (Monthly SIP of Rs. 10,000)

| 3 Year | 5 Year | 10 Year | 15 Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scheme Name | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) |

| SBI Magnum Income Reg Gr | 360,000 | 393,570 | 6.21 | 600,000 | 696,375 | 6.09 | 1,200,000 | 1,718,483 | 7.08 | 1,800,000 | 3,252,882 | 7.54 |

| S&P BSE India Bond Index | 360,000 | 398,828 | 7.15 | 600,000 | 705,135 | 6.61 | 1,200,000 | 1,760,908 | 7.56 | 1,800,000 | 3,393,020 | 8.05 |

| Debt: Medium to Long Duration | 360,000 | 391,897 | 5.91 | 600,000 | 686,029 | 5.47 | 1,200,000 | 1,618,382 | 5.89 | 1,800,000 | 2,997,778 | 6.5 |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Past performance may or may not be sustained in the future. Investors should always invest according to their risk appetite and consult with their mutual fund distributors or financial advisor before investing.